CSRS Survivor Benefits Calculation at Retirement - Federal

FERS Retirement Calculator - YouTube

Rumored Buzz on Retirement Calculator - Innovations Federal Credit Union

Refer to TSP's website for the Historic Annuity Rate Index elements. The non-TSP cost savings amount that you got in might consist of cost savings from different sources such as your cost savings account(s), non-TSP shared funds, and non-TSP retirement funds (economic sector 401-Ks, Person Retirement Accounts, etc.). Catch-up Contributions "Catch-up contributions" are extra tax-deferred worker contributions that staff members age 50 or older can make to the Thrift Saving Plan (TSP) beyond the maximum amount they can contribute through regular contributions.

The maximum "catch-up contribution" in 2012 is $5,500. If you got in a valid catch-up contribution quantity, this quantity will be consisted of in the overall TSP balance for purposes of calculating the estimated TSP annuity. Civil Service Retirement System (CSRS)Civil Service Retirement System. Staff members under CSRS were typically first employed prior to 1984.

Indicated on your SF 50 by a 1 in box 30 and the notation CSRS.CSRS-Offset, Workers are covered by CSRS and have social security protection because of a break in CSRS only coverage greater than 1 year. Shown on your SF 50 (Notice of Worker Action) by a C in box 30 and the notation FICA and CSRS (Partial).

CSRS & FERS Retirement Calculator - Federal Government Retirement Calculator

The 8-Second Trick For FERS - Office of Human Resources - NIH HR

Existing Dollars/ Today's Dollars, Approximated benefit amount, without future increases in prices or earnings. Need More Info? use the inflation rate for transforming to present year dollars. Present Wage, Although retirement annuity is based upon a person's high 3-year typical wage, for functions of the Federal Ballpark E$ timate, enter your present yearly wage.

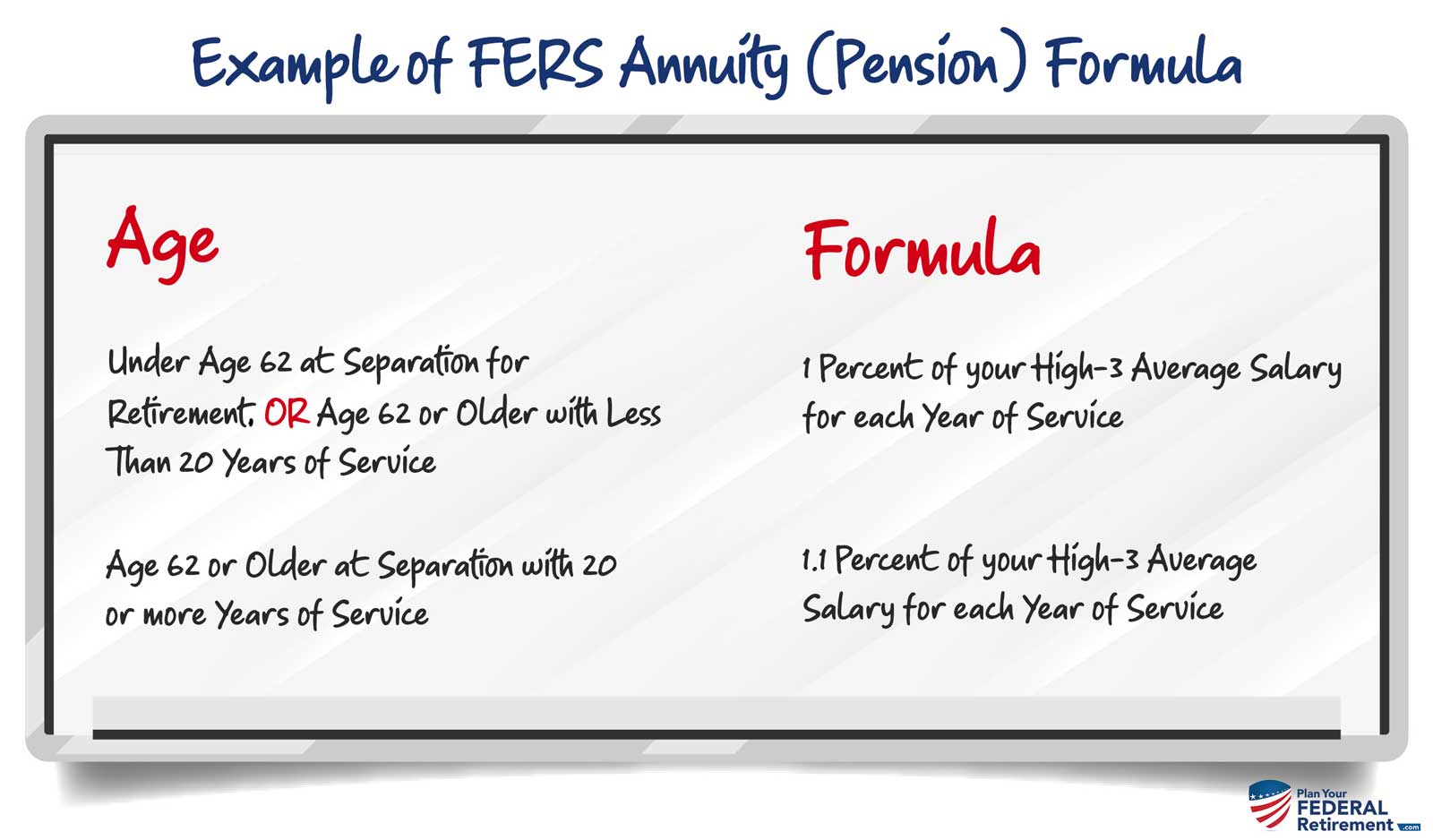

How To Calculate Your FERS Pension (VIDEO) - Your Federal Employee Benefits

FERS Deposits, Non deduction service carried out prior to January 1, 1989 requires a deposit to be reputable for the Basic Advantage portion of FERS and toward the retirement SCD. Non deduction service carried out after December 31, 1988 is not praiseworthy toward the Basic Benefit portion of FERS and is not to be included for the retirement SCD.

Federal Employees Retirement System (FERS)The Federal Worker Retirement System (FERS) was developed by Public Law 99-335 in Chapter 84 of title 5, U.S. Code and effective January 1, 1987. Many brand-new Federal workers worked with after December 31, 1983 are immediately covered by FERS. Particular other Federal employees not covered by FERS have the choice to transfer into the plan.